As South Korea assumes the APEC chairmanship in 2025, it does so at a profoundly uncertain moment in the global economy.The multilateral order, painstakingly built after the Second World War, seems to be eroding.Tariff walls continue to creep upward, supply chains are being rewired under geopolitical pressure, and the World Trade Organisation’s dispute settlement system remains impaired.However, the Asia-Pacific region continues to anchor global commerce.As of 2022, the twenty-one member economies of APEC accounted for approximately 62% of the global GDP, nearly 48% of world trade, and close to 40% of the world’s population.This sheer weight is enough to explain why APEC’s deliberations in 2025 will matter far beyond its membership.

For South Korea, hosting APEC after more than two decades is not only symbolic but also strategic.It signals Seoul’s intent to position itself as a middle power and rule-shaper in the Indo-Pacific’s evolving economic architecture. The themes that are of primary importance – Connect, Innovate, Prosper – neatly capture the dilemmas of the age:

The Macro Outlook: Slowing Momentum, Fragile Optimism

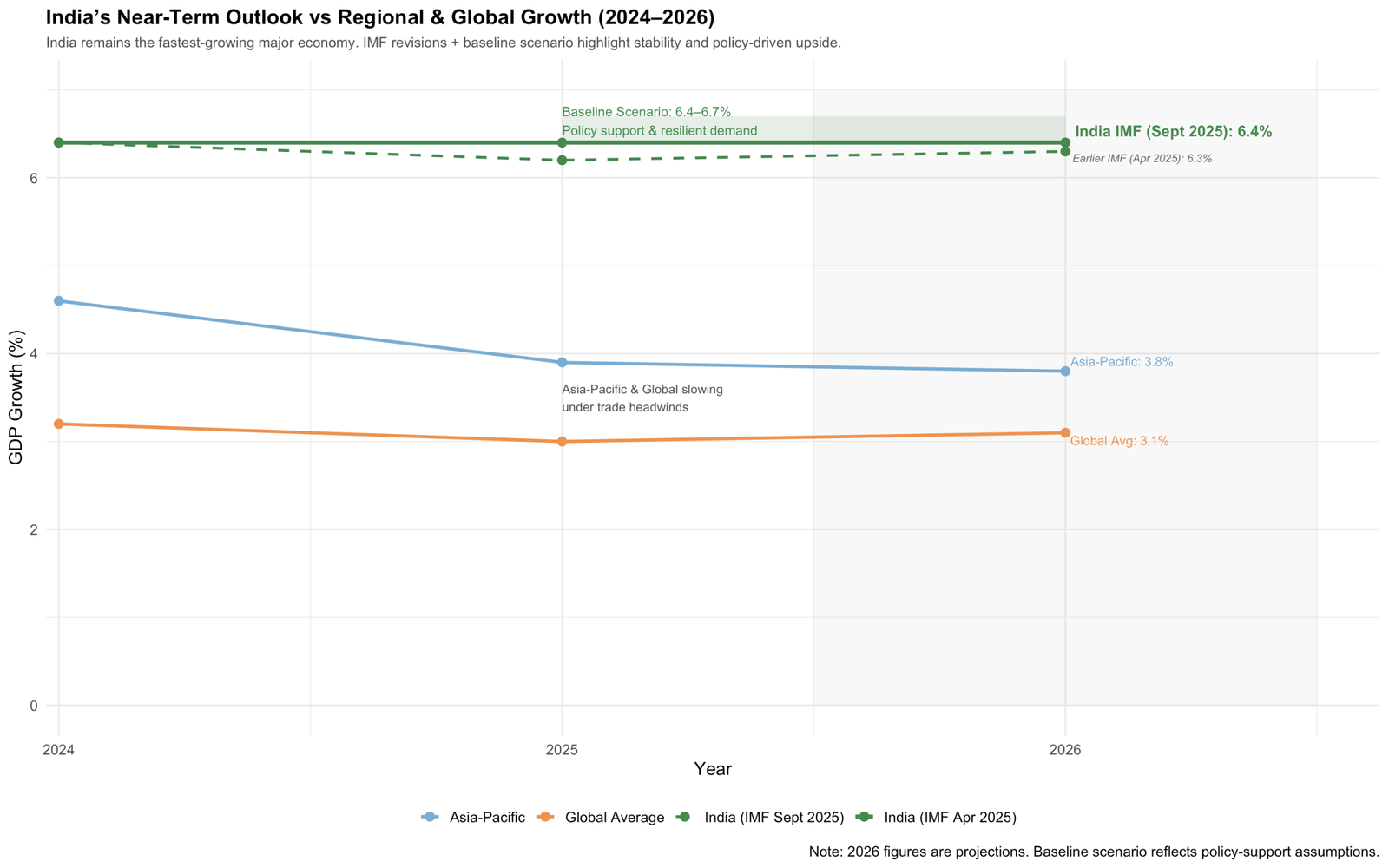

The economic outlook for the Asia-Pacific region is one of slowing momentum but enduring resilience. After surprising the world on the upside in 2024, regional growth is expected to moderate. According to the IMF’s Regional Economic Outlook (April 2025), growth in Asia-Pacific is projected at 3.9% in 2025, down from 4.6% in 2024, although it is still well above the global average of 3%.Inflation is easing across most economies, rendering central banks some policy space; however, uncertainty over trade measures and financial conditions tempers optimism.

Graph 1: Comparative GDP Growth (2024-2026)

This comparison highlights India’s outsized role as the fastest-growing large economy, underscoring why its indirect engagement with the APEC matters for the region’s future growth.

Trade dynamics tells a different story. The WTO’s August 2025 trade forecast projected that global merchandise trade would expand by only 0.9% this year after initially warning of a small contraction.This modest revision that moved upward, however, was driven less by organic demand and more by firms front-loading shipments ahead of the new US tariff measures.In other words, a temporary cushion appears to mask deeper structural weaknesses.

APEC has sounded the alarm.At a finance officials’ meeting held in Jeju in May 2025, the forum warned that regional export growth could slow down dramatically from 5.7% in 2024 to barely 0.4% this year as higher US tariffs on Chinese and allied exports ripple through regional supply chains.The message is clear: without deliberate policy coordination, APEC risks squandering its growth premium.

The Cost of Fragmentation

The spectre of fragmentation looms over every conversation around APEC. The IMF has repeatedly warned that the global economy, if split into rival trade blocs, could lose up to 7% of GDP in the long run, the equivalent of erasing the combined output of Germany and Japan.These costs rise sharply if technological decoupling in semiconductors, digital infrastructure, and green technologies accompanies tariff splits.

APEC economies are particularly vulnerable due to their significant involvement in the trade of intermediate goods, which includes the exchange of parts, components, and tasks that constitute modern value chains. When tariffs disrupt these trade flows, the resulting economic impact is exacerbated. For example, Vietnam’s effectiveness as an assembly hub is reliant on inputs from Korea, Japan, and China. In a similar vein, Mexico’s integration with North American value chains depends on regulatory coherence across the Pacific. Fragmentation increases the cost, slows the process, and reduces the competitiveness of such integration.

For India, this issue holds significant importance. Its efforts to integrate into global supply chains through Production-Linked Incentive (PLI) schemes, semiconductor investments, and electric vehicle (EV) value-chain integration are contingent upon the continued connectivity of APEC economies rather than their fragmentation.Such fragmentation would not only impact APEC members but also complicate India’s aspirations to emerge as a reliable “China-plus-one” hub.

Korea’s Presidency of APEC: Connect, Innovate, Prosper

In this context, the presidency of Korea’s at APEC must achieve outcomes that are practical rather than merely theoretical:

The primary objective should be to ensure the robustness of the trade infrastructure. This means pushing forward the interoperable customs digitisation, electronic certificates of origin, and the mutual recognition of “trusted trader” programs. Given its advanced digital infrastructure, Korea is well-positioned to lead the development of a supply-chain operating system for APEC.

The rapid pace of digital transformation is evident; however, inconsistent regulations pose a risk of market fragmentation.By 2025, it is imperative to expand the agenda to include AI governance, encompassing transparency requirements, compliance checklists tailored to small and medium-sized enterprises (SMEs), and ethical guidelines for sensitive applications.In this context, India’s digital public infrastructure models, such as the Unified Payments Interface (UPI) and Open Network for Digital Commerce (ONDC), present complementary innovations that could be harmonised with the initiatives of the Asia-Pacific Economic Cooperation (APEC).

Sustainability has become intrinsically linked to competitiveness. By enhancing the standards for transition finance, battery value chains, and renewable integration, Korea can significantly contribute to APEC’s climate agenda.India, as one of the largest markets for solar energy and green hydrogen, is well-positioned to both benefit from and contribute to APEC’s emerging frameworks.

Risks on the Horizon

Despite opportunities, three risks dominate the outlook for APEC 2025 and beyond:

The most immediate threat is renewed tariff retaliation across the Pacific. According to the forecast of WTO 2025, merchandise trade is expected to grow only 0.9% in 2025, compared to an average of 3-4% over the past decade. Much of this weakness stems from the front-loading of shipments ahead of new US tariffs on Chinese and allied exports, which could wipe out 0.3-0.5 percentage points of Asia-Pacific growth in 2026 if retaliations spiral. For highly trade exposed economies such as Vietnam (trade-to-GDP ratio 185%) and Singapore (311%), even modest tariff shocks can have disproportionately significant impacts.

While headline inflation across Asia eased from 6.2% in 2022 to an expected 3.3% in the year 2025, the risk shifted to currency markets. Dollar strength driven by diverging monetary policy with the United States has already pressured the yen, won, and rupiah. Official IMF estimates say that a 10% depreciation in emerging Asian currencies can raise debt-servicing costs by 0.7% of GDP on average, straining fiscal buffers. Smaller economies with limited reserves, such as Sri Lanka, Laos, and even frontier Pacific islands, remain particularly exposed to volatility spillovers.

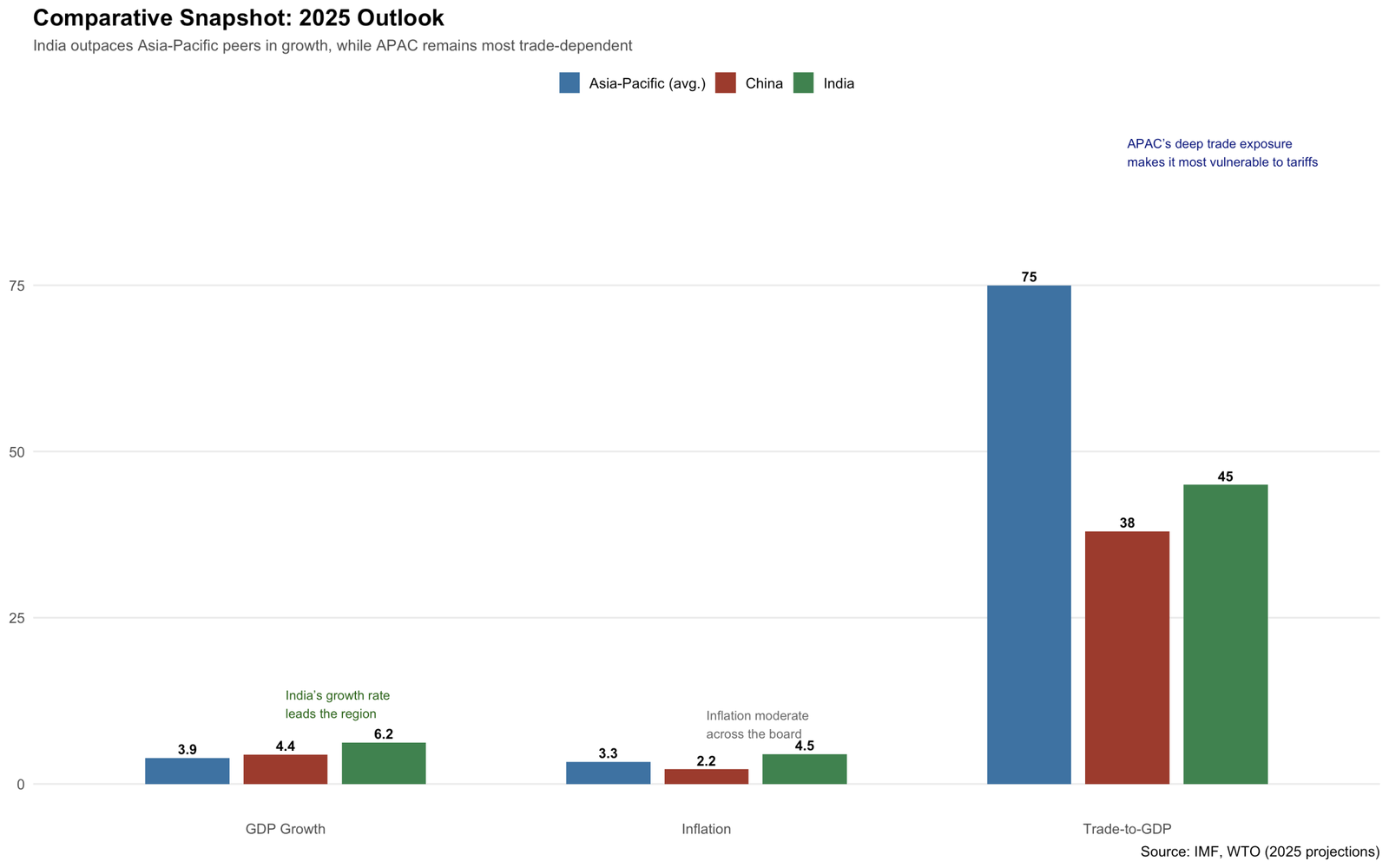

The economy of China, projected to grow 4.4% in 2025 (as per IMF estimates), remains central to regional supply chains but faces persistent fragilities.The weakness in the property sector continues to have a negative impact on domestic demand, while youth unemployment persists at approximately 15%.Given that China accounts for 30% of Asia-Pacific exports and imports, even a 1% slowdown in Chinese growth could potentially reduce growth in the neighbouring economies by 0.3%.This underscores the critical urgency of diversification strategies, such as India’s manufacturing initiatives and Mexico’s nearshoring efforts, as safeguards against overreliance on a singular demand hub.

Graph 2: Comparative Snapshot – 2025 Outlook

What success could look like

Success at APEC Korea 2025 should be measured not by grand communiqués but by practical, durable deliverables:

Why India should care

India may not be an APEC member, but its growth is highly intertwined with that of the bloc.With a 6.4% projected GDP growth in 2025, sectors such as IT services, pharmaceuticals, and electronics rely on Asia-Pacific value chains.Aligning with APEC’s rules, digital standards, and green frameworks can help India integrate, protect its exporters, and shape global norms from the outside in.

Although India is outside APEC, it can still shape the conversation through quiet coalition-building. Economies such as Vietnam and Singapore – where trade-to-GDP ratios exceed 180% and 300% respectively – are acutely vulnerable to tariff escalation. By aligning with such highly exposed partners via channels such as the APEC Business Advisory Council or overlapping forums such as IPEF and the G20, New Delhi can insert tariff discipline into the agenda without being seen as driving it. Indeed, the very fact that India is absent from APEC may work to its advantage: discussions on tariffs framed as regional vulnerabilities, rather than Indian grievances, would still yield benefits for Indian exporters and manufacturers while avoiding direct political costs.

Looking Ahead

South Korea’s APEC leadership in 2025 is a test of integration, amid fragmentation.If the bloc succeeds in digital borders, AI governance, and transition finance, the Asia-Pacific will remain the world’s growth anchor.By engaging practically, India can turn selective alignment into a strategic advantage, ensuring that the dividends of regional cooperation reach its rising economy.

Leave a Reply