Introduction: A New Phase in India-Africa Economic Engagement

India and Africa’s partnership has long been rooted in the shared histories of colonialism, solidarity through the Non-Aligned Movement, and post-colonial cooperation.However, their economic ties, although growing, have historically remained tethered to the exchange of raw materials.Indian imports from Africa have been dominated by crude oil, gold, and coal, whereas Indian exports have focused on low-to medium-value manufactured goods such as refined petroleum, pharmaceuticals, and vehicles.

This raw-materials-first model of trade is no longer tenable in a world that is reconfiguring its supply chains.As both regions aim to foster economic self-reliance, technological advancement, and industrial growth, their trade relationships must transition from transactional extraction to strategic co-development. The African Continental Free Trade Area (AfCFTA) and India’s recalibrated Foreign Trade Policy offer a timely platform to build robust India-Africa economic corridors that go beyond commodities and into integrated, future-ready value chains.

Current Trade Dynamics: Still Raw, Still Fragmented

India-Africa trade stood at USD 98.3 billion in FY 2022-23, a significant rebound from the pandemic-era lows, though still short of its peak in 2014-15 (USD 103 billion) (Ministry of Commerce and Industry, 2023). Despite this resurgence, the composition of trade remains lopsided. Nearly 60% of India’s imports from Africa comprise crude petroleum, gold, and coal, with Nigeria, Angola, and South Africa as the top suppliers (EXIM Bank of India, 2023).

India’s exports to Africa include pharmaceuticals (12.6%), automobiles and components (10.4%), refined petroleum products (9.2%), and electrical machinery (ITC Trade Map 2024).However, the potential for high-value service exports, especially in healthcare, education, and digital governance, remains underexploited.Moreover, India’s investments in Africa remain modest and concentrated. Mauritius alone accounted for over 34% of Indian FDI into Africa between 2000-2023, driven largely by tax incentives (DPIIT, 2023). Other countries, such as Morocco and Egypt, have received sector-specific FDI, primarily in fertilisers, telecom, and energy.This concentration limits the broader developmental spillover of India-Africa trade and investment.

Policy Shifts: AfCFTA meets India’s trade recalibration

Two major policy shifts offer new possibilities for transformation:

Opportunities: From Extraction to Co-Production

Africa’s demographic profile, characterised by over 60% of its population being under the age of 25 (UNDP, 2022), coupled with the growth of urban markets and increasing wage levels in Asia, presents favourable conditions for the development of light manufacturing industries (labour-intensive sectors producing consumer-oriented goods such as textiles, footwear, and plastics). Indian small and medium enterprises (SMEs) are strategically positioned to engage in co-investment opportunities in sectors such as textiles, footwear, plastics, auto components, and generic pharmaceuticals.

Numerous case studies have illustrated this potential. For instance, Kenya’s burgeoning pharmaceutical industry provides opportunities for Indian pharmaceutical companies. India’s Development and Economic Assistance Scheme (IDEAS) and EXIM Bank’s Lines of Credit have already facilitated industrial and infrastructure development projects, including industrial parks in Ghana and major public sector projects in Senegal. Nonetheless, it is imperative that these initiatives extend beyond the establishment of physical infrastructure to encompass support for skill development, standards compliance, and sustainable production practices.

To supplement its short-term Lines of Credit (LoCs), India should expand the use of Public-Private Partnership (PPP) models for industrial infrastructure development. PPPs can enable long-term commitments from Indian businesses while mitigating sovereign debt concerns for African countries. Industrial parks, common facility centres, and skills universities co-developed with African governments and anchored by Indian industry associations can ensure deeper ownership, sustainability, and post-project continuity. Leveraging blended finance to de-risk these PPP ventures will also be crucial, particularly in countries with limited fiscal space.

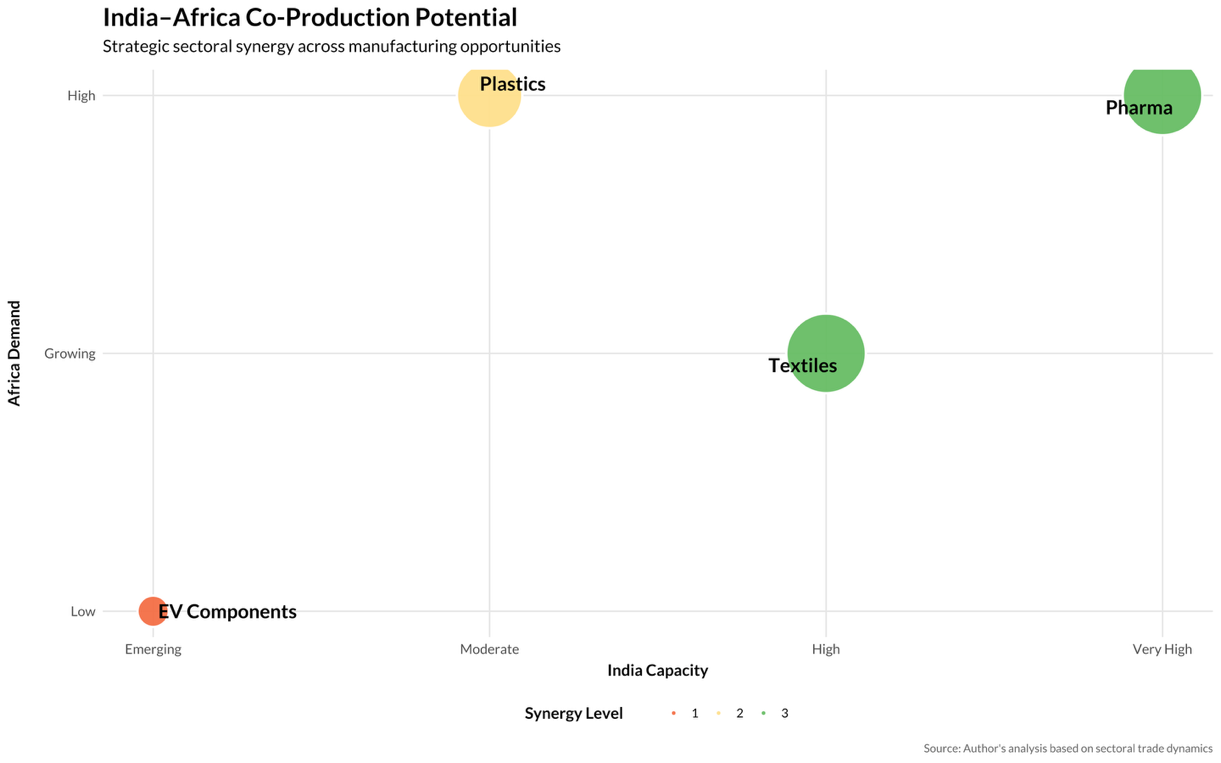

The bubble chart above shows the potential for India and Africa to collaborate in different sectors.It compares India’s ability to manufacture products with Africa’s need for them.Pharmaceuticals and textiles are the top sectors because India can produce a lot, and Africa needs them.This makes them suitable for joint projects and technology sharing.Plastics are in the middle but still have good chances because more Africans are buying packaged products.Electric vehicle parts are not performing well because Africa does not need them yet, and India is just starting to manufacture them.The chart suggests focusing on strong sectors and slowly building new ones.

India’s achievements in establishing Digital Public Infrastructure (DPI), exemplified by Aadhaar (digital ID), UPI (payments), and CoWIN (health platforms), position it as a pivotal partner in Africa’s digital transformation. For example, the UPI processed 100 billion transactions amounting to over USD 2 trillion in FY 2022-23 (NPCI, 2023), illustrating its potential for scalability.

Africa has made significant strides in digital financial inclusion, with mobile money platforms such as M-Pesa in Kenya serving 51 million users across the continent. This scenario presents a natural synergy for collaboration among the fintech, edtech, and health tech sectors. India has already initiated telemedicine and fintech platforms in Mauritius, Rwanda, and Ghana, supported by the Ministry of External Affairs’ e-VidyaBharati and e-ArogyaBharati initiatives. Expanding such initiatives across the continent through DPI partnerships could significantly enhance the India-Africa services Corridor.

Effective trade corridors are contingent on robust logistics support. Indian corporations, including Essar and Adani Ports, have made significant investments in African port infrastructure, with Essar focusing on Mozambique and Adani focusing on Tanzania. However, challenges persist in hinterland connectivity and multimodal logistics. The Indian Prime Minister’s Gati Shakti National Master Plan, which facilitates real-time infrastructure development mapping, is a viable model.

Such frameworks could be collaboratively developed with African partners to address issues related to last-mile delivery, warehouse infrastructure, and cold-chain logistics in landlocked nations such as Uganda, Chad, and Mali. Furthermore, India should consider utilising blended finance instruments (Blended finance refers to the strategic use of public funds or concessional capital to mobilise private investment in development projects)that integrate Lines of Credit (LoCs) with private equity and multilateral guarantees to support large-scale projects.

Challenges: Real but Surmountable

The path ahead is not without challenges.Infrastructure gaps are a serious barrier.Over 40% of Africa’s population lacks electricity, and inadequate road and rail networks significantly increase transaction costs.

However, trade facilitation bottlenecks persist. Customs procedures are inconsistent, standards are poorly harmonised, and cross-border procedures remain costly. While the WTO’s Trade Facilitation Agreement (TFA), which entered into force in 2017, has encouraged member countries to simplify and modernise customs processes, implementation across many African states remains uneven. India could work with AfCFTA institutions to support capacity building for TFA-related commitments, such as risk management, electronic payments, and pre-arrival processing.

Information asymmetries hinder MSMEs. A 2023 FICCI survey found that over 65% of Indian MSMEs had no access to market intelligence on African regulations.

India currently has only one full-fledged FTA in Africa (with Mauritius, 2021), while talks with Egypt and the SACU remain exploratory. Its only full-fledged FTA in Africa is the CECPA with Mauritius, signed in 2021. Currently, there is no institutional interface with the AfCFTA secretariat.

Strategic Outlook: Building corridors, not just transactions

To move beyond raw materials and toward resilient economic partnerships, India must embrace three core strategic shifts.

India and Africa are uniquely positioned to build a South-South trade model that goes beyond the extractive legacy of North-South trade. The combination of AfCFTA’s integration momentum and India’s development-centric trade strategy can lay the foundation for robust, diversified, and future-ready economic corridors.To do so, both regions must invest in physical and digital connectivity, incentivise co-production, and foster institutional frameworks for sustained and inclusive trade.The age of transactional trade must give way to transformative partnerships.

Leave a Reply