Africa’s investment horizon has recently broadened beyond the traditional mining and commodities sector, opening up new opportunities in sustainable agriculture, technology, healthcare, and educational infrastructure. Hopefully, this will help end the notorious “Resource Curse,” template which has plagued the continent for so long. The continent, which has a large youth population, is witnessing the emergence of scalable fintech and e-commerce platforms that can attract international investment. With more than 60% of its population under 25, Africa is the youngest continent in the world. As a result of demographic dividends, technological developments, and growing international recognition of its strategic significance, the continent is undergoing a tremendous transformation in its investment landscape. Africa’s demographic dividend is about to unlock as its working-age population will double by 2050. The progress in the African Continental Free Trade Area (AfCFTA) should further catalyse intra-African trade, contingent on infrastructure upgrades and regulatory alignment.

Current Investment Trends: A Record-Breaking Performance

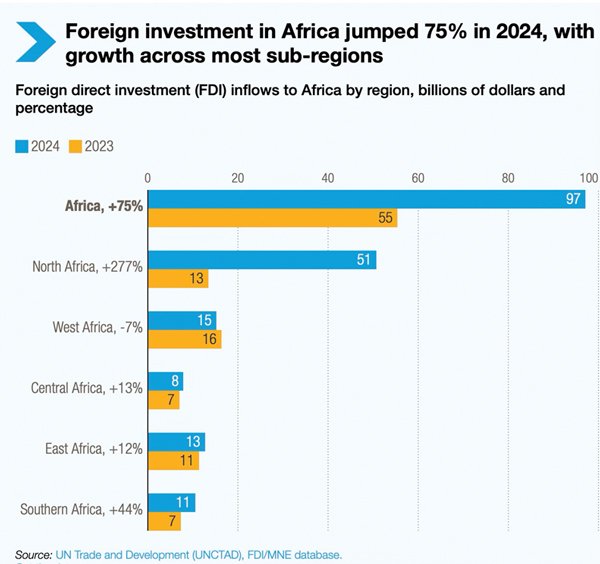

Foreign investment in Africa surged by 75% to reach an all-time high of $97 billion in 2024. This surge was initiated by liberalisation and facilitation efforts across the continent, according to the United Nations Conference on Trade and Development (UNCTAD). This remarkable growth stands in stark contrast to the global investment climate, where FDI flows faced significant headwinds due to current geopolitical tensions and economic uncertainties. The recovery is particularly noteworthy when compared to Africa’s 2023 performance. FDI inflows to Africa declined by 3% to $53 billion in 2023, making the 2024 surge even more significant. With renewed investor confidence, the investment recovery has been driven by multiple factors, including improved policy frameworks, infrastructure liberalisation, and strategic positioning for the global energy transition. Greenfield investment announcements included mega projects like a green hydrogen project in Mauritania, highlighting the continent’s growing role in renewable energy development.

Fig 1: Foreign Investment in Africa

Scope of Investment and Opportunities

Africa’s 2025 investment outlook is anchored in infrastructure and energy, alongside a range of high-potential sectors drawing strong international interest. Some of the salient features of the investment opportunities are as follows:

Table 1: Africa’s Infrastructure Investment Requirements

| Sector | Annual Need ($ Billion) | Current Investment Gap | Key Challenges |

| Energy | 190 | Massive shortage | Grid connectivity, generation |

| Transport | 45–55 | 60% shortfall | Roads, railways, ports |

| Water & Sanitation | 25–30 | 70% shortfall | Access, quality |

| ICT | 15–20 | 40% shortfall | Digital divide |

| Total Annual Need | ~280 | Major gap | Multi-sectoral |

Sources: UNCTAD Economic Development in Africa Report 2024, African Development Bank Infrastructure Report

The investment landscape varies significantly across African regions, reflecting different economic structures, resource endowments, and governance frameworks. The African Development Bank’s strategic approach recognises these regional differences in its investment allocation.

Table 2: Regional Investment Performance and Characteristics

| Region | Key Strengths | Major Investments 2024 | Growth Drivers |

| North Africa | Proximity to Europe, energy resources | Infrastructure, renewables | Energy transition, trade |

| West Africa | Natural resources, demographics | Mining, agriculture, fintech | Commodity demand, population |

| East Africa | Services hub, connectivity | Transport, ICT, energy | Regional integration, trade |

| Southern Africa | Mineral wealth, infrastructure | Mining, manufacturing | Resource extraction, processing |

| Central Africa | Natural resources, potential | Limited but growing | Governance improvements needed |

Sources: African Development Bank Regional Reports, UNCTAD Regional Analysis

Regional Disparities

There is a wide regional variability when it comes to which countries are receiving investment e.g. Egypt and Morocco, both in North Africa, are the continent’s top FDI destinations.Egypt’s joint megaproject with the UAE represented a $35bn investment, which alone drives up the continent’s FDI intake significantly. This underscores how certain middle-income economies have benefited from the re-shoring and near shoring trends induced by heightened global protectionism. After Morocco, South Africa is the third top inward FDI location by project volume. Some destinations that follow, such as Kenya, Tanzania, and Tunisia, have been held back “due to rising debt levels alongside regulatory uncertainty.” In terms of FDI projects opened, software and IT received 19% of investment between 2022 and 2024, particularly in Kenya, Nigeria, and Egypt. Communications and media have 8% of opened FDI projects, renewables and alternatives 7%, and metals and minerals 5%. In the renewable and alternative power sector, there is a major gap between the number of announced projects (32%) and the number of opened projects (7%). The report suggests this lag is caused by sector-specificities – in this case, high capex, long project cycles, and too much red tape. However, other sectors such as software and IT services, communications and media, and logistics have much higher conversion rates due to “a more execution-friendly environment”.

Future Outlook: Strategic Considerations for 2025 and Beyond

Africa’s post-COVID investment narrative spotlights emerging opportunities in healthcare, education, demographic-driven growth, continental integration, and green infrastructure. The pandemic exposed major gaps in medical infrastructure—from hospitals to pharmaceutical manufacturing and healthtech—spurring renewed investor focus on health systems and vaccine production capacity. At the same time, Africa’s working-age population is projected to double by 2050, creating urgent demand for job-rich sectors and underscoring the importance of realising its demographic dividend. Implementation of the African Continental Free Trade Area (AfCFTA) continues to enhance intra-African trade and investment, especially in energy and infrastructure, contingent on regulatory harmonisation and cross-border project development. Finally, meeting Africa’s development and climate targets requires doubling or tripling annual infrastructure investment, especially in renewables—African countries currently receive only 2–3% of global clean energy funding despite vast solar and wind potential.

Policy Recommendations and Investment Strategies

Africa faces an estimated $150–$190 billion annual infrastructure financing gap, equivalent to roughly 6% of GDP. To address this, policymakers should accelerate infrastructure spending, especially in clean energy, transportation, IT, and sustainable agriculture, build climate resilience as it loses $8.5 billion annually due to climate damage. The $29.2 billion in investor interest displayed at the 2024 Africa Investment Forum must be leveraged through enabling reforms and co-financing platforms with development banks. The investors should prioritise renewable energy projects, taking advantage of Africa’s massive solar potential. They should also explore technology and demographic-aligned opportunities—such as fintech and e-commerce—and embed climate-resilient approaches throughout their investment portfolios to create long-term, inclusive value.

Conclusion

Africa’s investment landscape in 2025 represents a remarkable turnaround story. The 75% surge in FDI, an all-time high, indicates renewed global confidence in African markets. However, this growth must be sustained and broadened to achieve transformational impact. The data reveals both the scale of opportunity and challenge. The $10 billion annual energy investment requirement represents one of the world’s largest infrastructure opportunities, while the African Development Bank’s record $11 billion in operations demonstrates institutional commitment to sustainable development. For investors, the key insight is that Africa’s investment landscape demands sophisticated approaches that balance opportunity with risk, immediate returns with long-term value creation, and international expertise with local knowledge. The $2.2 billion in investor expressions of interest at the 2024 Africa Investment Forum proves that international capital is ready to engage with African opportunities. The continent’s success in attracting and effectively utilising investment will determine not only its economic trajectory but also its role in addressing global challenges from climate change to demographic transitions. With proper policy frameworks and strategic investments, Africa’s 2025 performance could mark the beginning of a sustained transformation that benefits both investors and the continent’s growing population. As the data clearly shows, Africa is no longer an emerging opportunity—it is a current reality requiring immediate strategic attention from the global investment community for the betterment of Africa and for the betterment of the world

Leave a Reply