While most media attention focuses on the future of Ukraine under the next Trump administration, another more distant region is equally prone to disruption. In recent years, the relative peace and obscurity of the High North that contributed to the theory of “Arctic Exceptionalism” has collapsed. It has become abundantly clear that the Arctic is not immune to geopolitical developments. The Arctic Council – best known for its environmental and search and rescue partnerships between Canada, Denmark via Greenland, Finland, Iceland, Norway, Russia, Sweden, and the US – has largely ceased operations since the Russian invasion of Ukraine. The decline of the Arctic Council, paired with a rebalancing of Russian forces away from the Arctic, offers a historic opportunity for US leadership in the region.

What the War in Ukraine means for Russia’s Arctic force posture

While Moscow has recently expanded its military presence in the Arctic by reopening several Soviet-era bases and conducting large-scale military exercises, it has been forced to divert the vast majority of its military resources to Ukraine. The battlefield in Ukraine is inextricably linked to Russia’s Arctic power projection. While some of Russia’s specialized assets, such as its icebreaker fleet, obviously cannot be used in Ukraine, most of Russia’s Arctic military assets are fungible, and many have already been transferred to Ukraine. According to a study by CSIS, Russian Arctic ground forces have significantly deteriorated. It is reported that the 200th Motorized Rifle Brigade, 61st Independent Naval Brigade, 80th Arctic Motor Rifle Brigade, and the 76th Guards Air Assault Division have been involved in combat in Ukraine.

Figure 1 : Nagurskoye Air Base: Russia’s Northernmost Military Base

In addition to shifting military assets from the Arctic, Moscow has had to deprioritize dual-use infrastructure improvements planned to connect its many remote Arctic outposts and forward bases. While Russia continues to claim that it is increasing readiness of the Northern Fleet and ramping up icebreaker production, this is doubtful given the immense resource drain in Ukraine.

Thus, the cessation of the war in Ukraine would likely lead to heightened Russian power projection in the Arctic. This possibility is reinforced by Finland and Norway’s accession to NATO and increased Russian anxiety about the vulnerability of its critical nuclear assets in the Kola Peninsula. Therefore, the next administration’s position on the War in Ukraine will have important implications for the broader Arctic region.

How does Trump’s election influence the future of the Arctic?

Trump’s first term is the best time to evaluate how his next administration will influence the Arctic. While some sources have argued that a Trump administration is prone to aid Russia’s oil

and gas interests because of the alleged “friendly relations” between Putin and Trump, this notion can be easily dispelled. Trump’s focus on energy dependence will likely provide a boon to American oil and gas production in the Arctic at Russia’s expense. This is supported by the 2019 US Sanctions that targeted Russian deepwater Arctic drilling entities. Trump’s proposed energy sanctions in this term promise to be even more sweeping and no doubt will limit Russia’s desired LNG expansion. President Trump was a strong proponent of closing European markets to Russian LNG in favor of US LNG exports. Increasing US LNG supplies to Europe could prove to be a linchpin in the cross-Atlantic alliance and could be pivotal in closing the oil and gas loophole to the EU from which Russia has continued to profit. Moreover, increased competition with China, which dominates the global rare earth metals market, could lead to the US seeking new metal sources in the largely untapped Arctic region.

Figure 2 : NorthStar Facility (the only oil production permitted on US federal waters)

While it is too early to tell who exactly will compose Trump’s cabinet over the next four years – one fact is clear – it will be stacked with China hawks. Sanctions, secondary sanctions, tariffs, and non-tariff barriers that the Trump administration could impose on China will invariably affect Russia. Russia and China have rapidly accelerated their economic integration and interdependence since the War in Ukraine. The German Marshall Fund reports that Sino-Russian trade turnover in 2023 exceeded $240 Billion, and around 40% of Russian imports came from China. Russia is even more dependent on China for military technology. According to Carnegie, Russia has imported approximately 90% of its dual-use technology from China since the onset of Western Sanctions. Increased US semiconductor onshoring and limiting chip exports to China will almost certainly cause short to long-term disruptions to Russia’s war economy.

Sino-Russian economic and geopolitical interdependence has bled into the Arctic domain, and the next Trump administration will likely have heightened threat perceptions of any move by China in the region. China’s interest in the Arctic, embodied by $90 Billion in FDI, has already increased the salience of the Arctic in DC. While many observers remain skeptical of a second Trump Administration’s commitment to NATO, some indicators point to increased NATO cooperation in certain domains. In addition to the promise of greater American LNG shipments to Europe, there has been a perception shift toward China in many European capitals since the first Trump Administration, which is more in line with the American threat perception. In recent years, EU countries, from Lithuania to the Czech Republic, have taken outwardly adversarial stances towards China. Trump’s unprecedented 2019 Huawei ban has been replicated across Europe in recent years, with even Germany acceding to the ban by 2026. Moreover, since the war in Ukraine, more EU countries than ever are meeting their 2% defense spending commitment. Aligning EU and US threat perceptions of the PRC offers the opportunity for more

NATO integration.

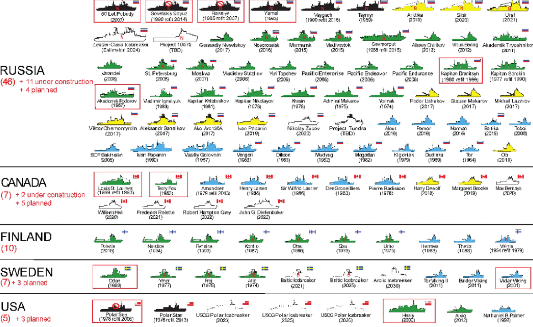

Another domain where NATO integration is possible under the Trump Administration is the trilateral ICE Pact with Canada and Finland. The Trump Administration is likely to ramp up the previous administration’s effort to produce icebreakers, and given the extremely limited and costly production of icebreakers, it is pivotal for the US to expand its involvement in the ICE Pact. This agreement utilizes the state-of-the-art Helsinki Shipyard, which was responsible for building some of Russia’s most advanced icebreakers until it was acquired by a Canadian company in 2023. The ICE Pact offers the US significantly lower overhead costs, cuts down on time, and reduces per-unit production costs of icebreakers by sharing the burden with other NATO partners. This plan of expanding icebreaker assets and replacing the aging and limited existing icebreaker fleet fits neatly into the Trump administration’s goal of increasing the total number of vessels and reversing the Navy’s Doom Loop. Icebreakers are still the most effective way to project power in the Arctic, conduct freedom of navigation operations, and protect US territorial claims and commercial interests. It is pivotal that the US close the gap between its icebreaker fleets and Russia’s in the upcoming decades.

Figure 3 : Global Icebreaker Fleets (2017)

It has become clear that the Arctic is not immune to geopolitical developments. The future of the Arctic is highly contingent on the War in Ukraine, Sino-American trade tensions, and Russian–NATO competition. The Trump administration is likely to increase oil, gas, and rare earth metal exploration in the high north in an effort to promote US energy independence and compete against the Sino-Russian axis. If the US pursues a major shipbuilding initiative and continues to participate in the ICE Pact, this could translate into a large-scale modernization and expansion of the icebreaker fleet. As with previous administrations, the key question is how much political will there is to spend resources on the High North. Under a Trump administration, the critical variables to track will be the feasibility and scale of commercial opportunities in the Arctic (in the form of energy and rare earth metal extraction) and whether China continues to expand its Arctic ambitions. If either of these conditions are met, this administration offers an opportunity to significantly enlarge the icebreaker fleet, develop Arctic infrastructure, promote NATO cohesion on the China threat, and ultimately secure long-term US interests in the region.

Leave a Reply