The Much-Anticipated US Elections and What’s at Stake

As diplomats and officials from around the world gathered in New York for the annual United Nations General Assembly, one question dominated the attention of global leaders: who will lead the U.S. in 2025? The stakes of this election go far beyond America’s borders. The next president will play a critical role in addressing the world’s most pressing challenges: climate change, global health, and international cooperation. And the choice between Kamala Harris and Donald Trump could not be clearer.

Vice President Kamala Harris and former President Donald Trump offer two starkly different visions of how the U.S. should engage on global challenges ranging from economic inequality to global health. Their opposing views on climate action, pandemic preparedness, and infectious disease prevention, among other challenges, will significantly influence not just the daily lives of Americans but the trajectory of millions of lives around the world.

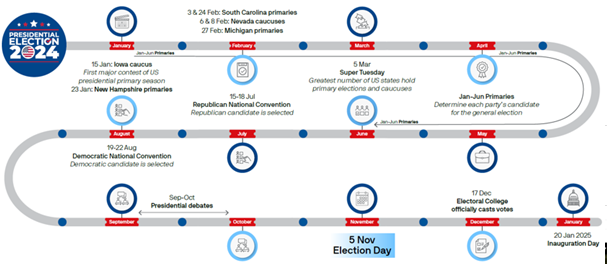

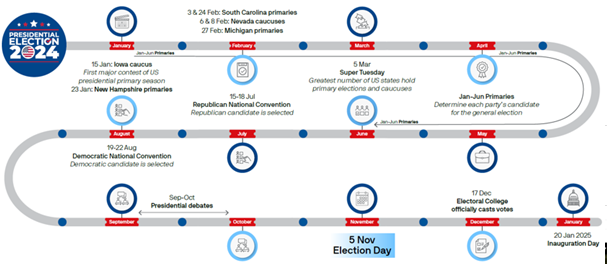

The 2024 Election timeline

Source: 270towin, National Conference of State Legislatures. Data are as of August 31, 2024.

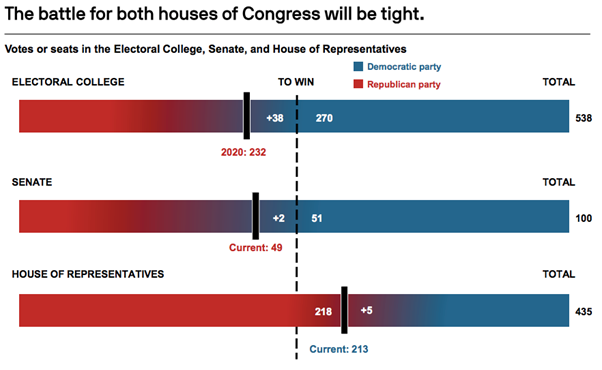

What is at stake in the Electoral College and Congress?

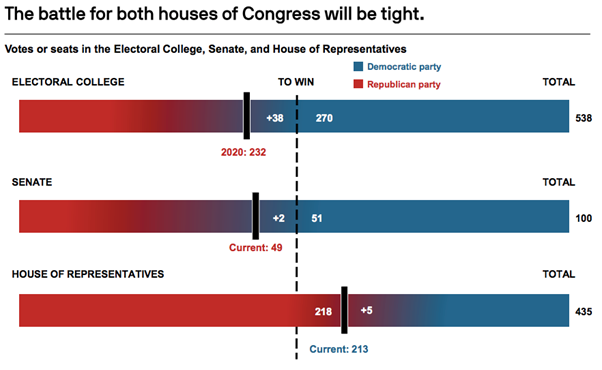

The presidential race will captivate voters most, but critical to a president’s success in implementing their agenda is the configuration of Congress, comprised of the Senate and House of Representatives. Here is what’s at stake, and the paths to victory for each:

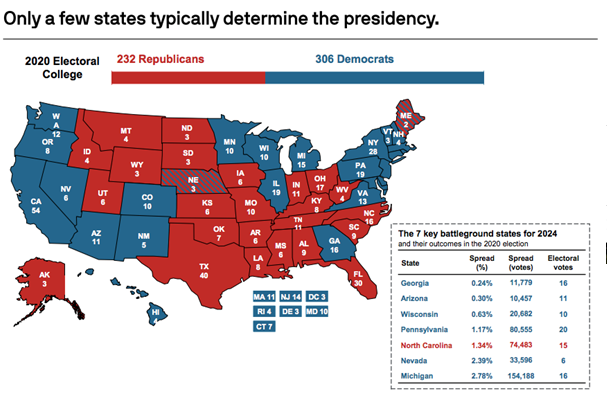

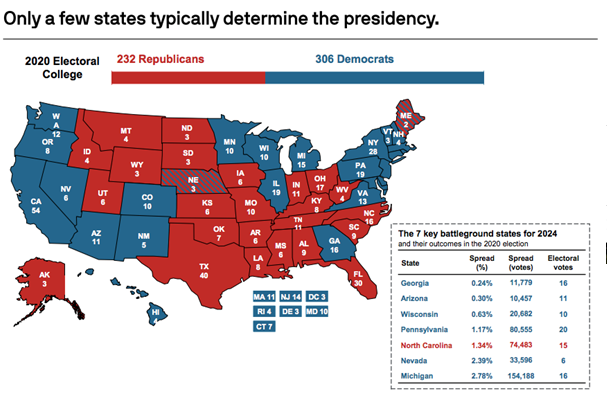

Electoral College

The outcome of the 2024 US presidential elections will likely come down to just a few thousand votes in a few pivotal swing states, mirroring the close outcomes of 2016 and 2020. There are 538 electoral college votes available, and 270 are required to win. Most election experts have distilled this race to 7 battleground states, where the margin of victory is expected to be fewer than 500k votes. Those key battleground states are Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania, and Wisconsin.

In 2020, President Biden won the election with 306 votes, 74 more than former President Trump who earned 232 votes and 36 more than the 270 required to win. Although 36 votes may seem like a significant gap, in 2020, three states (GA, AZ, WI) accounting for 37 electoral college votes were determined by under 43,000 individual votes. Several races were called days after the election, and five races had less than a 2% spread of votes between candidates — GA, AZ, WI, PA (won by Biden) and NC (won by Trump).

Senate

The Senate currently consists of 48 Democrats, 49 Republicans, and 3 Independents that typically vote with the Democrats (ME, AZ, VT). There are 100 seats in the Senate and Senators serve staggered 6-year terms, so every two years, about one-third of the Senate is up for election. In 2024, 34 seats are up for election, 23 are currently held by Democrats and 11 are held by Republicans.

According to The Cook Political Report, there are three toss-up states, all currently held by Democrats: Nevada, held by Jacky Rosen; Ohio, held by Sherrod Brown; and Montana, held by Jon Tester. Democratic Senator Joe Manchin of West Virginia will not run again, so that seat is very likely to flip to the Republican party. The Republicans need two seats to control the Senate, or just one if they also win the White House as the vice president casts tie-breaking votes. Therefore, there is not much ground for Democrats to gain, and they are at risk of losing their slim majority.

House of Representatives

All 435 seats in the House of Representatives are up for election every two years. The House currently consists of 220 Republicans, 212 Democrats and 3 vacant seats due to retirement. The Democrats would need to win 5 seats to take control of the House. According to Ballotpedia, there are 52 battleground districts, accounting for 13.1% of House races.

- Electoral College: There are 538 electoral college votes available, and 270 are required to win. In 2020, President Biden earned 306 votes and former President Trump earned 232 votes. The Republican candidate would need to pick up 38 votes relative to 2020.

- Senate: The Senate currently consists of 48 Democrats, 49 Republicans, and 3 Independents who vote with the Democrats (ME, AZ, VT). The Republicans need two seats to control the Senate, or just one if they also win the White House.

- House of Representatives: The House of Representatives currently consists of 221 Republicans, 213 Democrats, and 3 vacant seats. The Democrats would need to win 5 seats to take control of the House.

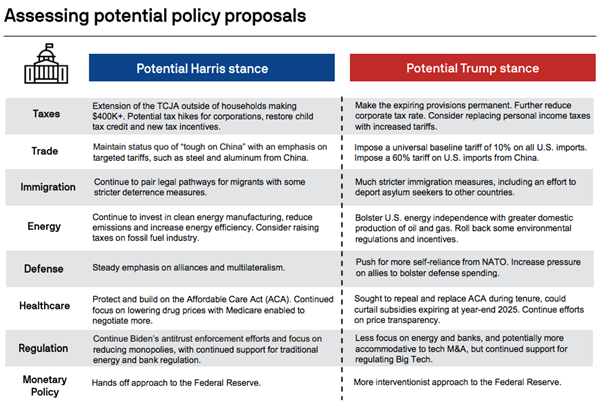

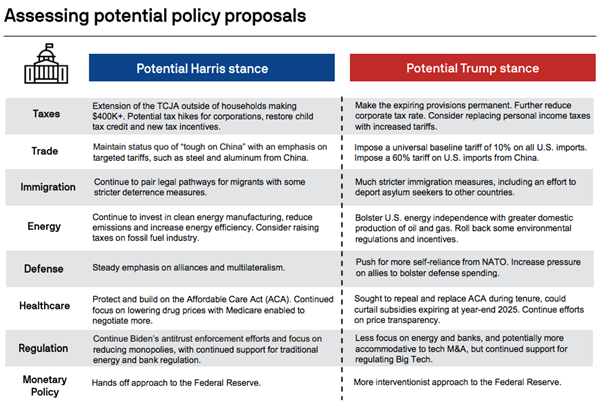

- In the long run, it is policy, not politics, which matters most for the economy and markets.

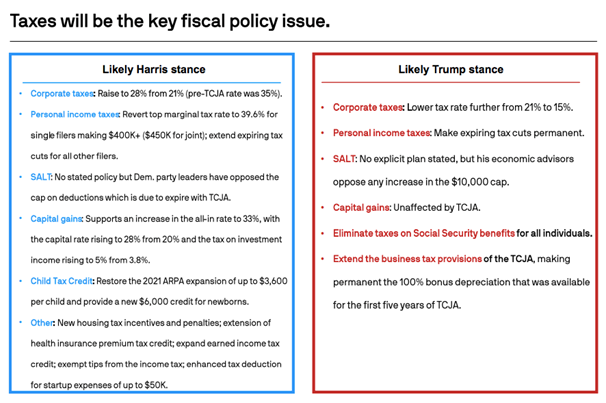

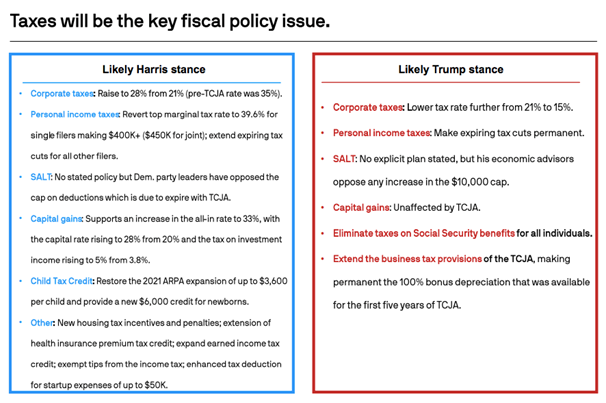

- The Democratic and Republican platforms vary on many key policy issues, but there are also some areas of bipartisan support on protectionist trade measures, a (partial) extension of the TCJA and improved immigration control.

- While Harris joined the presidential race later in the election cycle, her platform is unlikely to differ much from Biden’s. However, each candidate’s policy positions are subject to change as the election cycle progresses, and again once elected in office. There is also no way to know which policies would be prioritized or successfully passed through Congress once in office— suggesting investors will want to take campaign rhetoric with a grain of salt.

- Without the urgency of a recession or a pandemic to address, it’s unlikely the next administration will champion major fiscal spending plans.

- However, many provisions in the 2017 TCJA Act are set to expire at the end of 2025, giving whoever is elected to the White House a chance to reset fiscal policy.

- A Trump administration would try to make the expiring income tax provisions permanent, explore new tax cuts, renew the business tax provisions from the initial years of the TCJA and consider new tariff increases as budgetary offsets.

- A Harris administration would attempt to extend the expiring personal income tax cuts for all single filers making below $400K (or $450K for joint), expand the child tax credit, push for new housing tax incentives and attempt to raise the corporate tax rate to 28% from 21% (compared to the pre-TCJA rate of 35%).

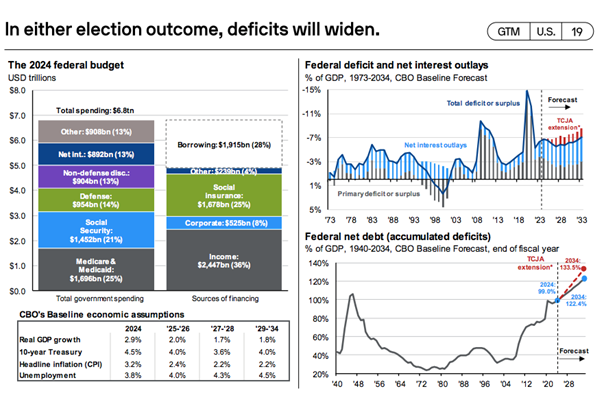

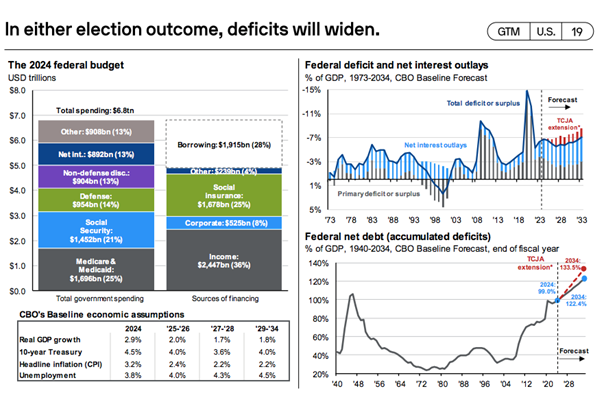

- In either outcome, deficits will likely continue to widen in the coming years.

- Over the next decade, the budget deficit is set to remain steady between 5-7% of GDP. This is not only historically high but also will have to be financed at 3-5% interest rates going forward. Therefore, an increasing slice of the deficit will go towards net interest payments, which is unlikely to boost economic growth (or inflation).

- While we don’t see a significant risk of a fiscal crisis, a consequence of higher deficits will likely be upward pressure on rates.

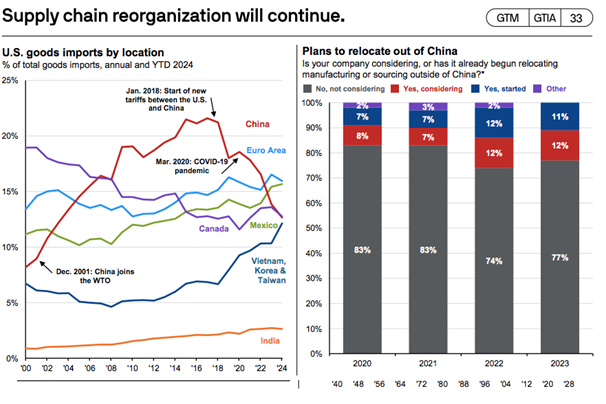

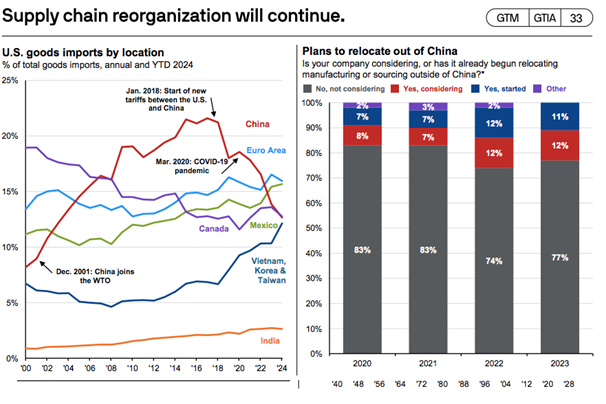

- The secular trend of “friend-shoring” and diversification from China has been underway since the escalation of trade tensions with China in 2017/2018. Since then, the share of U.S. imports from China has been declining while imports have increased from Europe, Mexico, Canada, East Asian countries and India to close the gap.

- Regardless of the outcome of the election, we expect this trend will continue, with companies continuing to diversify away from China. Notably, this dynamic has also introduced investment opportunities for those beneficiaries of trade realignment.

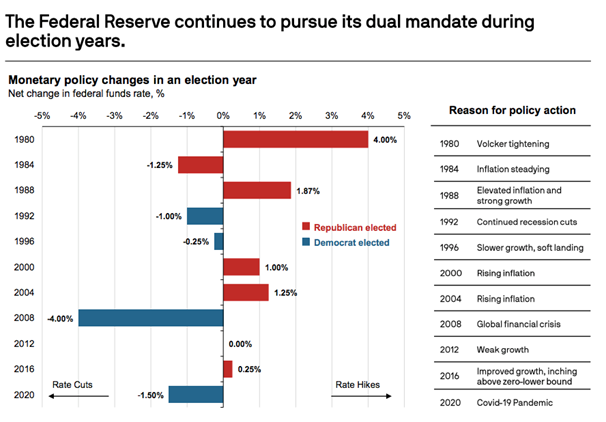

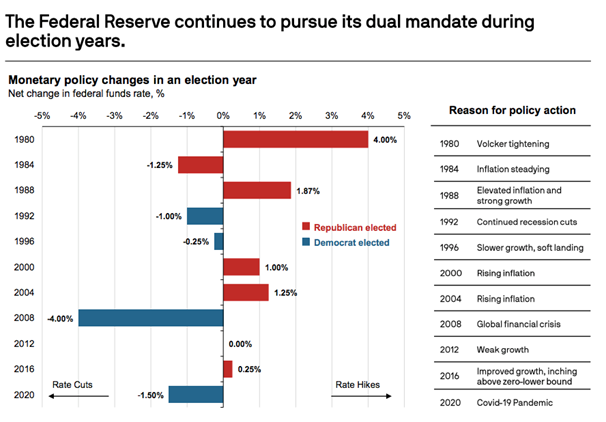

- Historically, the Fed doesn’t sit on the sidelines during election years, but rather continues to pursue its dual mandate of price stability and maximum employment, while maintaining its independence from politics.

- Regardless Since 1980, the Fed has either hiked or cut rates in every single election year except 2012, when rates were at zero and the economy was still healing from the financial crisis. Otherwise, the Fed cut rates in five election years and hiked in five election years.

- The Fed’s policy actions during election years are also fully explained by the economic context related to its dual mandate.

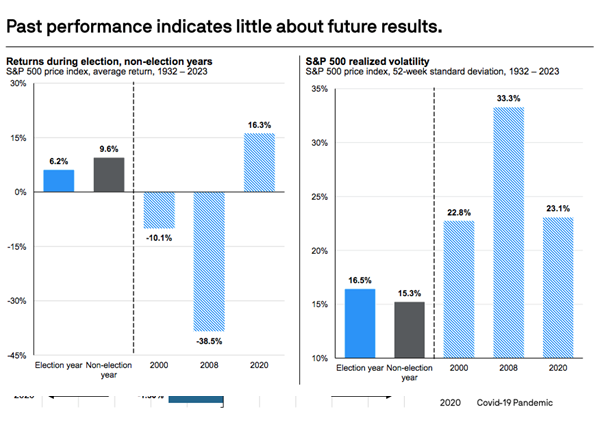

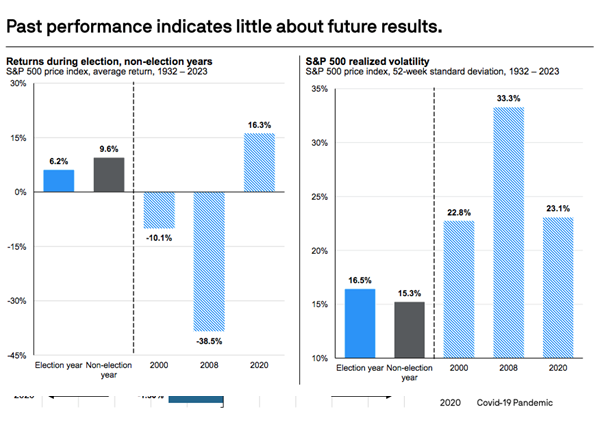

- Returns tend to be lower and volatility tends to be higher during election years as elections breed uncertainty.

- However, averages don’t tell the full story, as recent presidential election years have been particularly volatile with historic market drawdowns.

- For example, the 2000 sell-off was related to the bursting of the tech bubble; 2008 was the onset of the financial crisis; and 2020 was the onset of the pandemic. 2020 experienced a sharp correction and then a strong rebound, both completely unrelated to the election.

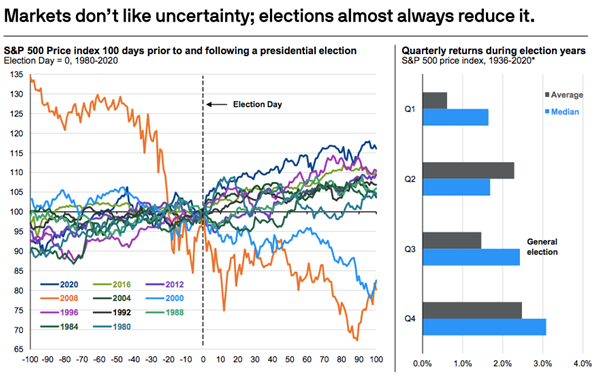

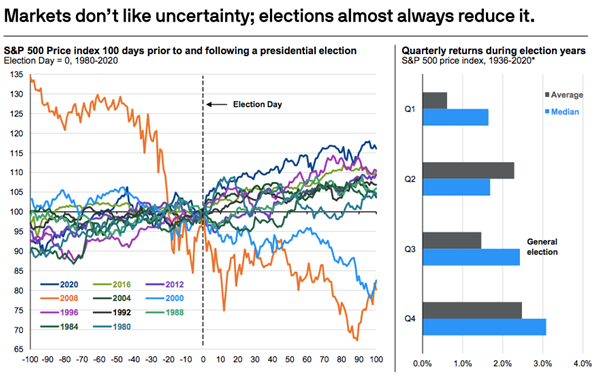

- Markets do not like uncertainty, and elections foment uncertainty. Typically, in the lead-up to an election, markets face headwinds from this uncertainty.

- However, after election day, that source of uncertainty is cleared, and, regardless of the result, markets move on and focus on the fundamentals.

- In almost all presidential elections since 1980, markets moved higher after election day. The two notable exceptions were in 2000, when the tech bubble bursting continued to weigh on markets and the economy headed into recession in 2001, and in 2008, when the onset of the Financial Crisis weighed heavily on markets into 2009.

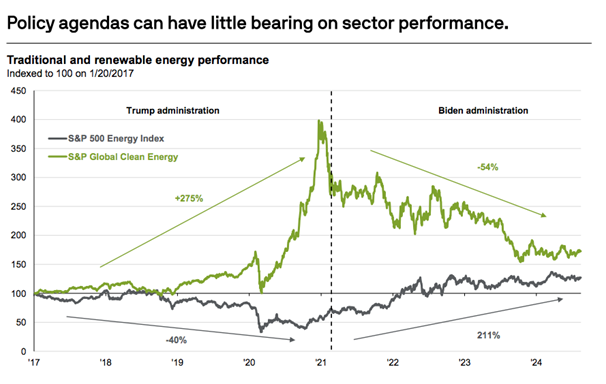

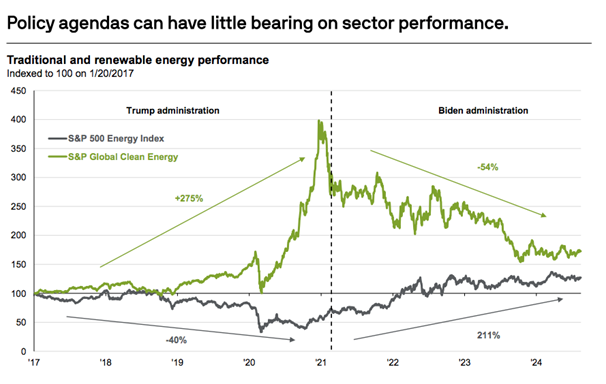

- Investors often consider how they should be tweaking portfolios in an election year to positionmore defensively for volatility or more opportunistically for potential rallies in certain sectorsbased on policy expectations. However, it is very difficult to construct reliable sector strategiesbased on different political outcomes.

- For example, Biden campaigned on scaling back fossil fuels and galvanizing renewables andpassed the largest-ever fiscal commitment to the climate of $369 billion through the InflationReduction Act. On the other hand, President Trump campaigned vigorously to support thetraditional energy industry during his presidency.

- Sector performance was the opposite of what one might expect. Under Trump, the S&P 500Energy index was down -40%, while the S&P 500 Global Clean Energy index was up 275%. UnderBiden, the S&P 500 Energy index nearly doubled, while the S&P 500 Global Clean Energy indexwas down -50%.

- Ultimately, macro forces drove markets: varying supply/demand and interest rate environmentsdrove performance more than any policies or intentions by the White House.

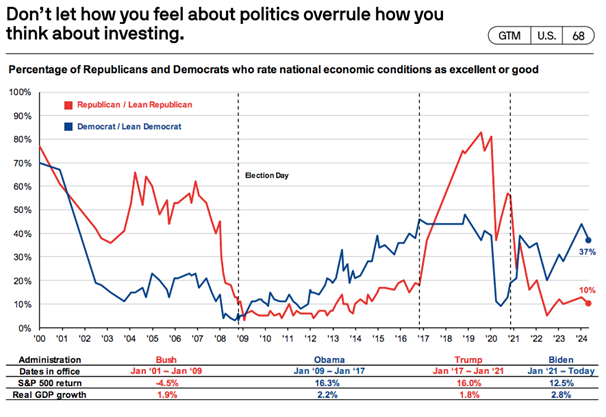

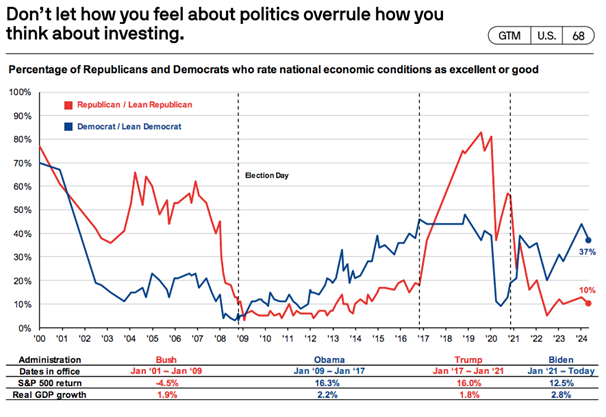

- People tend to invest based on their perceptions of the economic and investment environment. However, these perceptions can be heavily skewed by political preferences.

- A Pew survey on American’s views of the state of the U.S. economy shows that when a Republican is in office, those who identify as Republican tend to view the economy as doing a lot better than Democrats do. The opposite is true for when a Democrat is in the White House.

- Moreover, if an investor sat in cash due to fears about political outcomes, they would have left alot of money on the table. Under both the Obama and Trump administrations, the S&P 500 returned an average of 16%, and 12% under Biden. Despite these large swings in economic perceptions, the economy grew at or around its 2% average growth rate through each administration.

For middle-class families in America, these conversations are not just about abstract foreign policy. They are about the jobs that can come from leading the world in clean energy. They are about staying safe from global health threats by working with other nations to prepare for and respond to pandemics. And they are about ensuring a stable global economy that benefits American workers and businesses.

All told, Harris’s vision of global cooperation aligns with the urgency of transnational threats. She understands that if the U.S. retreats from its commitments, it will not just be the millions of American middle-class families who will suffer: global health security will be weakened, the risk of pandemics will increase, and climate disasters will worsen.

Diplomats and officials from around the world are nervously watching the U.S. presidential election, as they know that the stakes are high. In the next five years, the decisions made in the White House will determine the fate of our collective human health. The next U.S. president will not just be making decisions for America—they’ll be setting the tone for the world. Will we work together with our allies and international partners, or will we step back and let others lead? The consequences of that choice will reverberate far beyond their borders.

Leave a Reply